CIVISTA BANCSHARES (CIVB)·Q4 2025 Earnings Summary

Civista Bancshares Beats on Strong NII Growth, Closes Farmers Acquisition

January 29, 2026 · by Fintool AI Agent

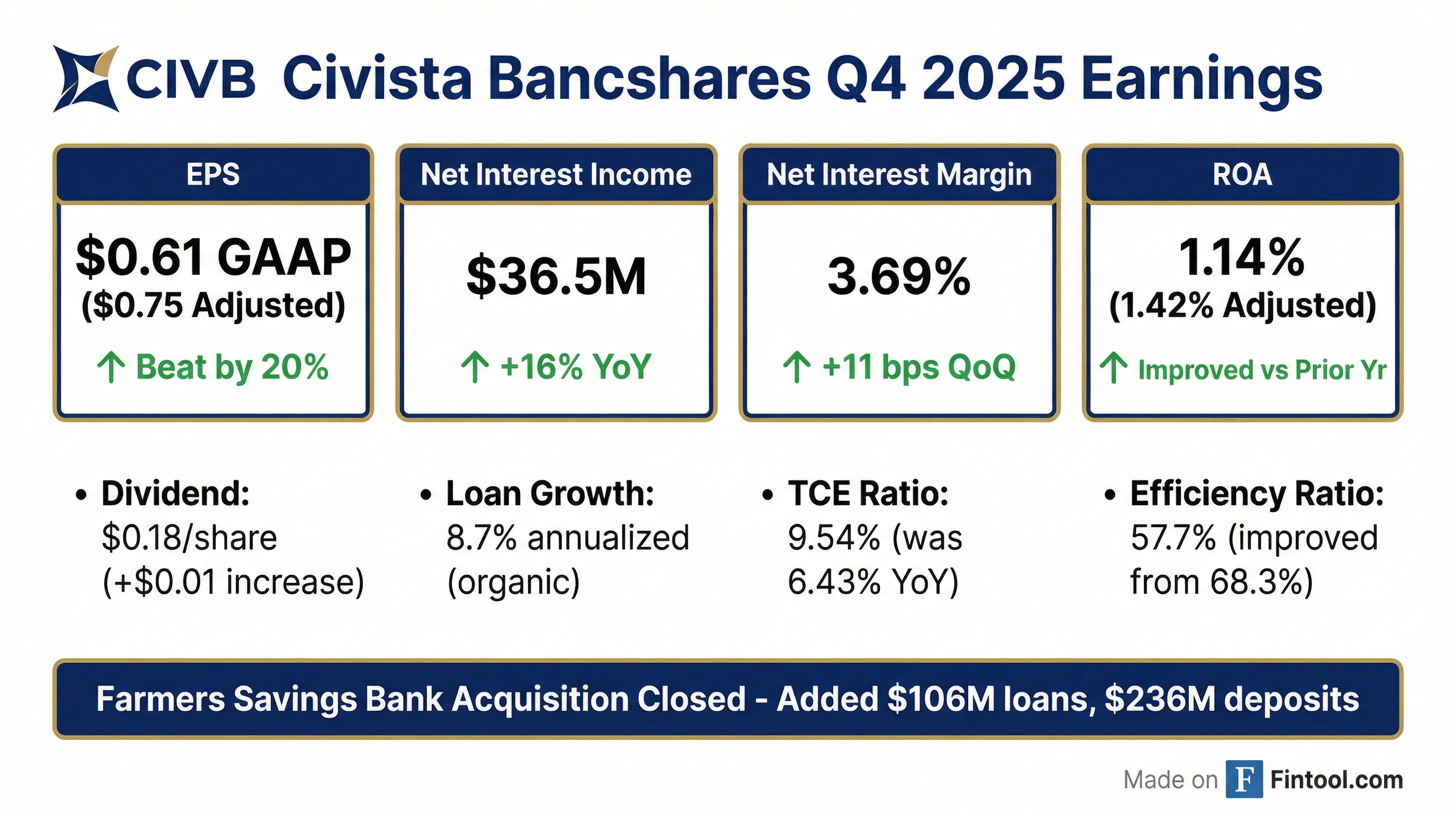

Civista Bancshares (CIVB) delivered a strong Q4 2025, beating EPS estimates by 20% and revenue by 3.1% while successfully closing its acquisition of Farmers Savings Bank. The Ohio-based community bank reported GAAP EPS of $0.61, which included $0.14 per share in non-recurring acquisition costs. Adjusting for these items, EPS was approximately $0.75. Net interest income grew 16% year-over-year to $36.5 million as the net interest margin expanded 11 basis points to 3.69%.

The stock rallied 4.4% following the release, trading at $24.31 — near its 52-week high of $25.59.

Did Civista Beat Earnings?

Yes, convincingly. CIVB beat on both the top and bottom line:

Values retrieved from S&P Global

The GAAP EPS of $0.61 was reduced by $0.14 per share due to non-recurring expenses related to the Farmers Savings Bank acquisition, including system conversion and integration costs.

For full-year 2025, net income increased 46% to $46.2 million ($2.64 per diluted share) compared to $31.7 million ($2.01 per diluted share) in 2024.

What Drove the Beat?

Net Interest Income Expansion

The primary driver was strong net interest income growth. NII of $36.5 million represented:

- +$1.9M (5.5%) vs linked quarter

- +$5.1M (16%) vs Q4 2024

The net interest margin expanded to 3.69%, up 11 basis points sequentially. Management achieved this through disciplined deposit pricing — funding costs declined 19 basis points while earning asset yields only declined 8 basis points.

Farmers Savings Bank Integration

The acquisition of Farmers Savings Bank closed in November, adding:

- $106 million in loans

- $236 million in low-cost deposits

System conversion is scheduled for the weekend of February 7-8. Management expects minimal additional acquisition-related expenses going forward.

Expense Control

Efficiency ratio improved dramatically to 57.7% from 61.4% in Q3 and 68.3% in Q4 2024. Adjusted non-interest expense was $27.6 million, flat with the prior quarter. Full-year adjusted non-interest expense declined $2.4 million (2.1%) from 2024 driven by lower compensation and equipment costs.

What Did Management Guide?

Management's NIM guidance assumes one rate cut in June and another in Q4. If rates stay flat, the margin would be "a little bit higher at the end of the year."

How Did the Stock React?

CIVB shares jumped 4.4% on the earnings release, trading at $24.31 — up from $23.29 at the prior close. The stock is now trading within 5% of its 52-week high of $25.59.*

Values retrieved from S&P Global

What Changed From Last Quarter?

Capital Position Strengthened Materially

Civista achieved two long-standing strategic goals:

- Tangible Common Equity Ratio: Increased from 6.43% a year ago to 9.54% at December 31, 2025

- CRE Concentration: Reduced from 366% of risk-based capital to 275% — now within regulatory comfort zone

These improvements were enabled by the July capital offering and strong organic earnings generation.

Loan Growth Resumed

After purposely muting CRE loan growth earlier in 2025 to manage concentrations, management became "a little bit more aggressive" following the capital raise. Organic loan growth (excluding Farmers) was $68.7 million in Q4, representing an 8.7% annualized growth rate.

Dividend Increased

The board raised the quarterly dividend by $0.01 to $0.18 per share, representing a 3.2% annualized yield and a ~30% payout ratio. Management views this as "a sign of confidence" in Civista's earnings power.

Key Q&A Highlights

On Loan Growth Mix (Chuck Parcher, President)

"I think we'll see kind of go back to more normalized growth in 2026, meaning that the commercial area will lead that growth, both C&I and commercial real estate. We did have quite a bit of growth in 2025 in the residential side... If we get a little bit of a blip downward in interest rates, we feel like we'll probably move some of that to the secondary market."

On Digital Banking Success

Management highlighted early success with the new digital deposit platform:

"Just last month... we were surprised that we opened 28 new checking accounts last month through the digital front."

A more comprehensive digital marketing campaign will launch after the Farmers system conversion.

On Credit Quality

One participation loan of approximately $8 million was placed on non-accrual during the quarter after maturing in November. Management emphasized this was an isolated instance and expects resolution to take "the better part of 2026." The credit brought over from Farmers was described as "very good."

On Competitive Positioning

Management noted significant disruption in Ohio banking markets due to recent M&A activity:

"The WesBanco Premier one was a big one that was last year, and we've got some talent from there... We're not only getting calls from those employees at those institutions, but we're also getting calls from the clients of those institutions."

Credit Quality Snapshot

Non-performing loans increased $8.5 million to $31.3 million during the quarter, almost entirely due to the single participation loan mentioned above. Net charge-offs for 2025 were slightly lower than 2024.

Profitability Trends (8 Quarters)

*Values retrieved from S&P Global. Q4 2025 ROA/ROE impacted by acquisition costs — adjusted ROA was 1.42% per management.

Forward Catalysts

- Farmers Integration Completion (Feb 7-8) — System conversion should unlock full expense synergies and cross-selling opportunities

- Digital Deposit Growth — Marketing campaign launch post-conversion could accelerate funding

- M&A Disruption Benefits — Talent and customer acquisition from Ohio bank consolidation

- Loan Growth Resumption — Improved capital position enables more competitive CRE pricing

- Potential Fed Cuts — Management guidance assumes June and Q4 cuts; NIM would benefit further from a pause

Key Risks

- CRE Concentration: While improved, 275% CRE/risk-based capital remains elevated

- Single Credit Exposure: $8M participation loan could pressure NCOs if workout extends

- Integration Execution: Farmers system conversion carries operational risk

- Rate Sensitivity: Continued rate cuts could pressure asset yields faster than funding costs